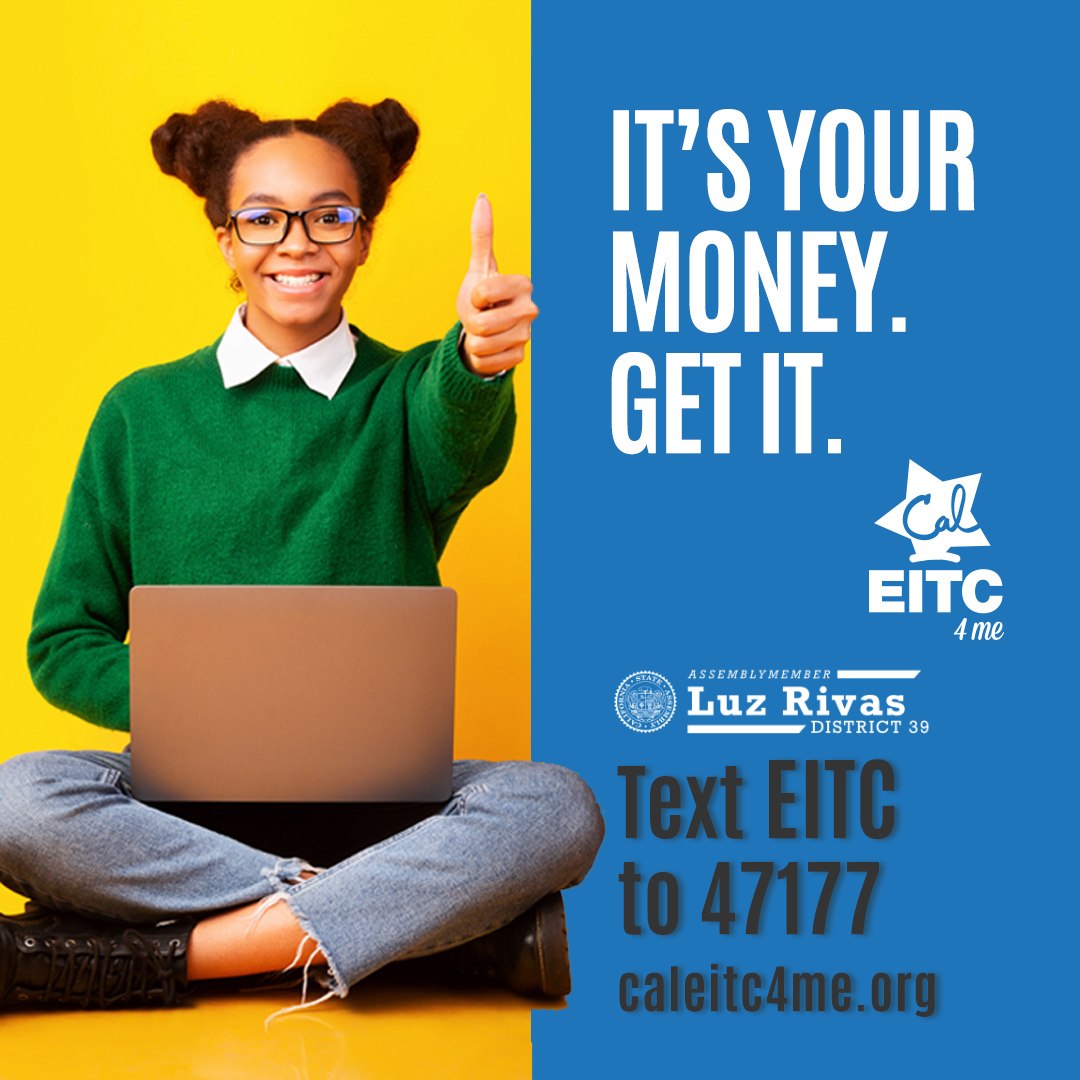

AD 39, important CalEITC information below!

The California Earned Income Tax Credit is available for more families this year. This cash-back credit is designed to put money in the pockets of low-income working families and individuals. Claiming this credit is easy. Eligible taxpayers just need to file a state tax return.

You could get up to $3027 more back in this year’s tax return if you qualify for California’s Earned Income Tax Credit. Starting with the 2020 tax year, people with Individual Tax ID Numbers now qualify.

Those who were self-employed in 2021 may also qualify. If you do not owe taxes, CalEITC will provide you with a tax refund when you file your return. If you owe taxes, CalEITC reduces the amount of taxes you might owe and may allow you a refund when you file your taxes.

For more information, text EITC to 47177 or visit caleitc4me.org.